Deloitte Off-Campus 2025 Drive – Multiple Job Roles

Deloitte Off-Campus 2025 Drive: An exciting opportunity is available to enthusiastic and organised individuals for a position at Deloitte Touche Tohmatsu India LLP as an intern with responsibilities in Compliance, Assessment & Research, Advisory Services, along with Tax Controversy management and Litigation. Based in Delhi, the internship provides practical experience in a fast-paced professional work environment. It also provides the opportunity to experience tax compliance frameworks, tax advisory services, as well as litigation assistance. Perfect for those who are pursuing an occupation in law, taxation or financial advisory, the position fosters skills advancement in research and analysis as well as regulatory compliance.

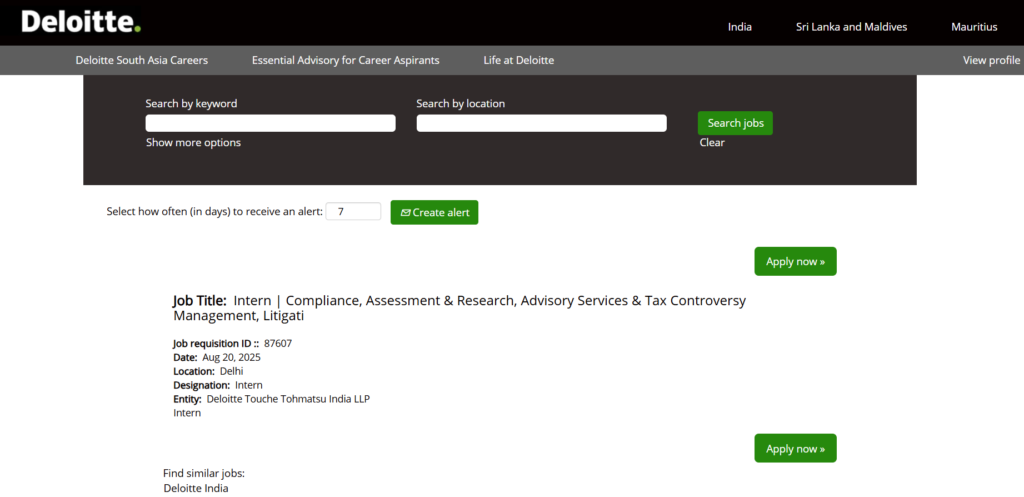

Job Overview

- Job Requisition ID: 87607

- Date: August 20, 2025

- Location: Delhi

- Designation: Intern

- Entity: Deloitte Touche Tohmatsu India LLP

Key Responsibilities

- Conduct a thorough study of tax regulations as well as compliance requirements. Legal frameworks to help support advice services.

- Assist in preparing reports as well as presentations, and documents for tax assessments as well as lawsuits.

- Help the team analyse the client’s data to find the areas of compliance and suggest practical solutions.

- Assist senior professionals in coming up with strategies to manage tax controversy and the resolution of disputes.

- Review and review the legal content of documents and case law, and updates to regulatory documents to ensure the accuracy of advisory deliverables.

- Participate in meetings with clients, making notes and providing suggestions under the direction of mentors who have experience.

- Keep organised records of findings from research along with case progress, as well as checklists of compliance for external and internal audits.

- Stay informed of changes in tax laws, tax laws, and other trends in the industry to provide pertinent help to the team.

Qualifications

- The pursuit of a Master’s or Bachelor’s degree in law, Commerce, Finance, Accounting, or another related subject.

- A solid academic record, with an average CGPA in the range of 7.0 or higher.

- Basic knowledge about Indian law, regulations on compliance and litigation processes is highly recommended but not required.

- Expert proficiency in MS Office (Excel, Word, PowerPoint) for data analysis and report creation.

- Excellent analytical and research skills, with a keen eye for particulars.

- Strong communication skills that are strong in both writing and verbal abilities to communicate findings.

- Ability to collaborate with others and handle multiple tasks with tight deadlines.

- A proactive attitude and a desire to grow and adapt to a changing work environment.

Skills and Competencies

- Analytical Thinking: The ability to decode the complexities of tax and compliance concerns to give clear, actionable information.

- Expertise in Research: Knowledge of the legal database, tax journal and regulatory resources to ensure accurate information collection.

- Time Management: Ability to prioritise work and provide quality work in the timeframes specified.

- Problem-Solving: Skills for identifying compliance risks and recommending efficient solutions.

- Pay attention to detail: Accuracy when reviewing documents, analysing data, and ensuring that the information is error-free delivery of products.

- Collaborative Teamwork: Comfort teamwork in teams with cross-functional roles to accomplish common goals.

Why Join This Internship?

This job with Deloitte Touche Tohmatsu India LLP provides a unique opportunity to gain knowledge of compliance, tax assistance, and litigation. Interns will collaborate with industry experts and gain insight into tax-related controversies in the real world and challenges to regulatory compliance. The position offers a chance to build a foundation of research analysis, analysis, and professional communication, which are crucial to a successful career in the field of tax or legal advice. The exposure to prominent clients and complicated projects can help boost your professional development and establish a solid base for future opportunities in the field.

Work Environment

In the vibrant city of Delhi, this internship program offers an inclusive and collaborative work environment. Interns work with different teams, using modern equipment and resources to create innovative solutions. The role requires a combination of research on their own and teamwork that ensures that students are able to learn in balance. Flexible working arrangements are possible, based on the specific requirements of the project and policies of the organisation.

Application Process

Candidates who are interested should submit a resume along with a cover letter that outlines their passion for Compliance, Tax Advisory or litigation. Applications should be made online through the Deloitte careers portal on or before September 10th 2025. Candidates who are shortlisted will go through the screening process, which includes interviews to determine their ability to perform the job. Check that the application materials are accurate and complete to ensure that there are no delays in the process.

More Latest Off-Campus Hiring 2025 Jobs:

- SBI Off-Campus Recruitment 2025 – Clerk Role – Apply Link

- EY Hiring Drive 2025 – Apply Link

- Hexaware Off-Campus Hiring 2025 – Apply Link

- Nokia Off-Campus Drive – Apply Link

- Turing Off-Campus Hiring 2025 – Apply Link

- Tech Mahindra Off-Campus Hiring 2025 Drive – Apply Link

- JioStar Off-Campus Hiring 2025 – Apply Link

- AspenTech Off-Campus Hiring – Apply Link

- Deloitte Off-Campus Biggest Drive 2025 – Apply Link

- IBPS Off-Campus Recruitment 2025 – Apply Link

- Accenture Off-Campus Recruitment – Apply Link

- Cvent Off-Campus Drive – Apply Link

- Wipro Off-Campus Recruitment 2025 – Apply Link

- Capgemini Mass Hiring Drive – Apply Link

- Siemens Off-Campus Drive 2025 – Apply Link

- Principal Off-Campus 2025 Drive – Apply Link

- Trinity Off-Campus Hiring 2025 – Apply Link

- PwC Off-Campus Recruitment 2025 – Click Here

- Zoho Off-Campus Drive 2025 – Apply Link

- Deloitte Off-Campus Recruitment – Click Here

- Cognizant Off-Campus Hiring 2025 Drive – Click Here

- Unacademy Off-Campus Hiring – Click Here

- Salesforce Off-Campus Recruitment 2025 – Click Here

- Morningstar Off-Campus 2025 Hiring – Click Here

- IBM Off-Campus Recruitment 2025 – Apply Link

- Capgemini Mass Hiring 2025 – Click Here

- Tower Research Capital Off-Campus Hiring 2025 Drive – Apply Link